January 9, 2023

Majority of my audiences range from high school students all the way to employees in corporate America. That means that a person in one audience could be fourteen years old while in another audience forty five years old. Recently I spoke to an audience of 300 students and their families so as you can imagine […]

EVEN A SIX YEAR OLD GETS IT!

Majority of my audiences range from high school students all the way to employees in corporate America. That means that a person in one audience could be fourteen years old while in another audience forty five years old. Recently I spoke to an audience of 300 students and their families so as you can imagine the ages were all over the place.

Because I was hired to speak to the students my presentation was focused on the tips and strategies they needed around money. I have had a lot of speaking engagements over the last month and the ones that have involved “adults” (who I characterize as those over twenty five maybe even thirty) have brought some interesting questions.

Each question is different, but they all come from of a place of “I don’t understand why you are saying this or saying that?” Some of the questions were truly sincere and a search for understanding. The others were an attempt to prove their way of thinking around a money concept was right.

The most common question always comes around my thoughts on credit. I know that people can live a life without worrying about a credit card or a credit score. I have seen thousands of people with my own eyes do it. To those who are skeptical in the audience they can not imagine life going on without credit, because that is all they have known. That is all they have been taught.

Whenever I speak to students I go through the concrete facts and let them all make their own decision. I have been doing this for over eight years and 100% of students after looking at the facts decide they want to live a life that does not govern itself by credit. They want to govern themselves by a life built on a large bank account.

When I left the stage of the 300 person event a couple of people came up to me to confirm what was said on stage. First was a father of two who was 50+ years old and he said after I explained how a credit score is determined that it was the first time it clicked with him that it was a debt score.

A grandfather came up to me next and he was in his seventies. He said to me “You were teaching good up on that stage. You are completely right about our mothers and grandmothers not being able to get credit and that they saved their money. They saved their money and built their own homes, bought their own cars, started their own businesses and much more!”

The last person to come up to me was a woman from another country, but lived in the US and had just bought a home. Being here in America she had began to think like Americans and that credit was the end all, be all. She said I made her think about the country she is from and how they don’t have credit or credit scores. People in her country TODAY save their money and buy everything with the money they have in their bank accounts!

Each one of these individuals brightened my day and I could see that the two who may have thought credit was important before are now seeing things a little differently. Convincing “adults” is a lot harder than it is with students and that is why I only present the concept to students and not during my speaking engagements to adults. Young people get it and they get it fast. Because they get it, they will surpassed the adults in their life when it comes to wealth because they will couple the new information with my financial tips and strategies I provide.

I am sure you are wondering why I titled this blog post “Even A Six Year Old Gets It.” It is because a couple of weeks ago my six year old daughter was able to join me for the first time at a speaking engagement. This speaking engagement was a women’s conference for a church. This of course was an audience of “adults” so usually I would leave out the “credit” slide, but this time I added it after going back and forth about it in my head.

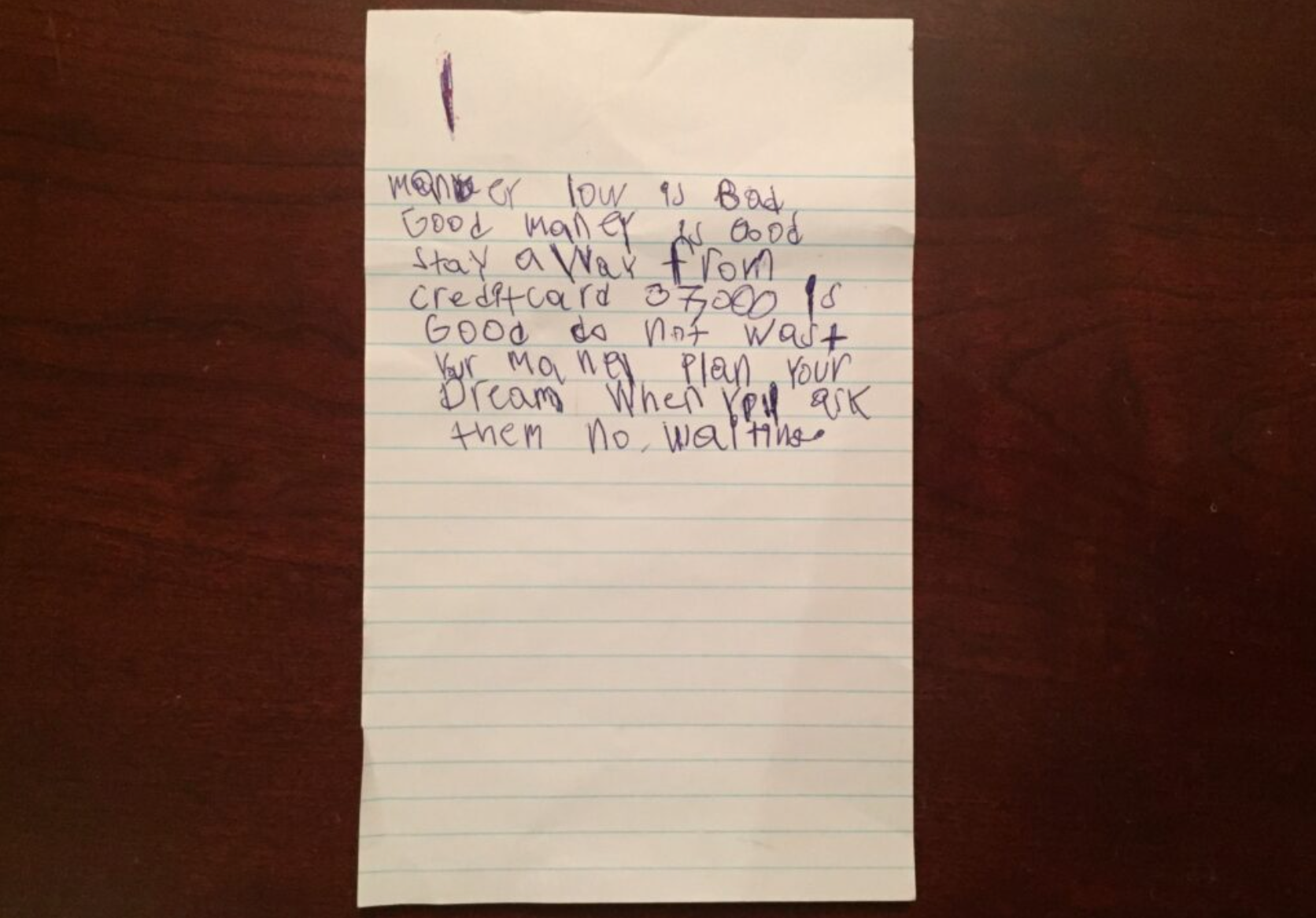

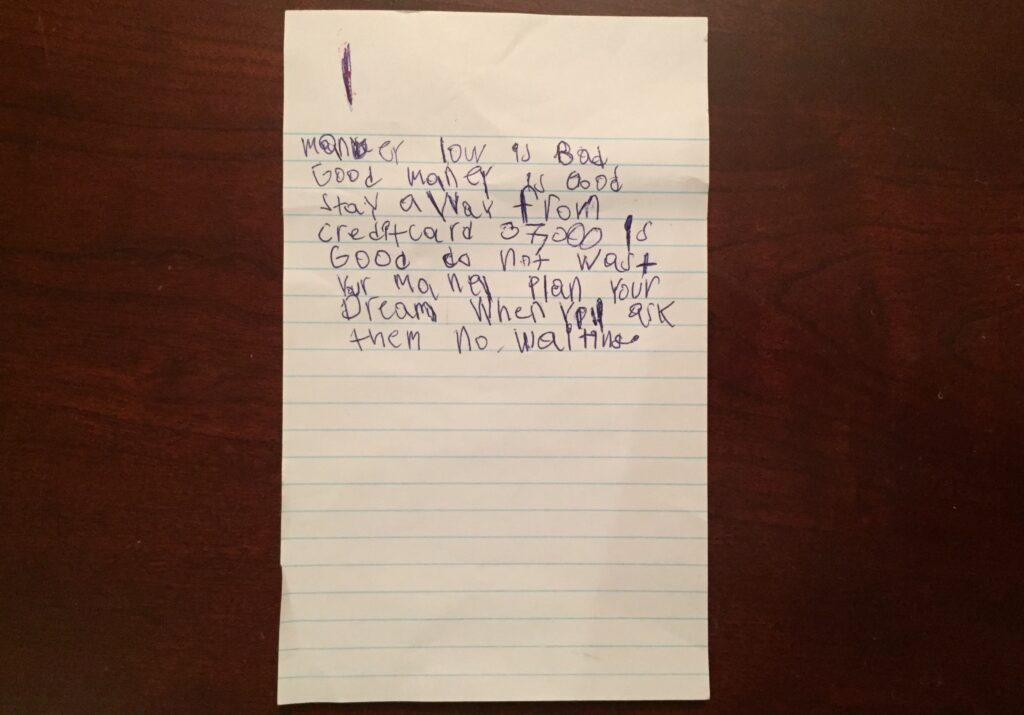

The reason that I added it is because of multiple verses in the Bible around not being in debt. Of course someone asked me a question around credit cards and scores, but once I explained everything they agreed. When my daughter and I arrived home that evening she showed me the notes she took while I was talking. The one that stood out the most was that she heard “stay away from credit card.”

See, when I was a little older than her my mother, her grandmother took me over to the trashcan with a envelope in her hand. The envelope was a credit card offer. She ripped the envelope up right in my face and told me never to get a credit card. Many parents don’t talk about money with their children and by doing that you are doing them a disservice. You are causing them potential financial harm in the future. They can learn the basics of money just as well as you can.

How do I know?

Because even my six year old gets it!

If you enjoyed this post please make sure to like and/or share with others!

Make sure to subscribe to the blog so you never miss a money tip!